money order vs bank draft

Money orders also have fees but theyre often less than wire transfers. A pay order is a mode of payment that is to be cleared in the very specific branch of the bank that issued it.

|

| Difference Between Pay Order And Demand Draft Video Goodreturns Youtube |

Canada Post charges 750 per money order.

. The cost of a Canadian postal money order is between 450 and 700 depending on the currency and the destination of the money order. Funds are immediately taken from your RBC bank account in exchange for the draft guaranteeing. Banks also issue money orders whenever. What are the Advantages of a Bank Draft.

The recipient can cash the order at a local bank or. You get them from the post office and the money is guaranteed by Canada Post. Money orders are cheaper than bank drafts. A money order gives anyone the power to move cash around without the use of a bank account.

Additionally they are more convenient method for transferring large. A money order can be. Where a financial institution offers both products money orders will always be more affordable. Money Order is a mode of payment that requires the payer to pay a specified amount of money before-hand.

Pay order also called Bankers Cheque is a type of payment which gets cleared in the same branch of the bank which issued it where demand drafts are a mode of payment which. The charge for issuing a bank draft is around the same as a money order. Where a financial institution offers both products money orders will always be more affordable. It means that the payee is.

Demand draft is a mode of payment that gets cleared in any branch of. Can be used for amounts up to 99999. You dont need a bank account to get a money order. Money orders are better suited for lower-value exchanges while bank drafts and certified cheques.

A bank draft cant be cancelled or. What is a Bank Draft. A money order is a manuscript or document alike to a check. Guaranteed availability of funds Unlike a personal check a bank draft is guaranteed by the bank.

That makes them a useful tool for people who cant get a bank account. The key difference is that a certified cheque is used by its customers to pay for goods and services and a bank draft is an instrument one can use for the same except that bank. Money orders do not include personal information such as your banks routing number and your bank account number. However a bank draft is a check drawn on a banks funds after accepting the amount from the issuers account whereas cash is used when purchasing a money order.

Pay order also called Bankers Cheque is a type of payment which gets cleared in the same branch of the bank. Canada Post charges 750 per. A bank draft is a safe form of payment because it is an official check that is printed and guaranteed by the bank. Made out by a financial.

A draft might be most useful when amounts over 1000 CADUSD need to be sent. 3 rows Money Order. Money orders are cheaper than bank drafts. The total fees can be tens of dollarsmore than other forms of electronic money transfers.

Regarding costs a money order can. A money order allows you to transfer funds up to 99999. A Bank Draft is a physical means of providing payment to a third party. Bank draft vs money order Heres a breakdown of what makes.

|

| Bank Draft Vs Certified Cheque Vs Money Order Nerdwallet Canada |

|

| Bank Draft Or Check Draft Check By Phone Fax Web Or Email |

|

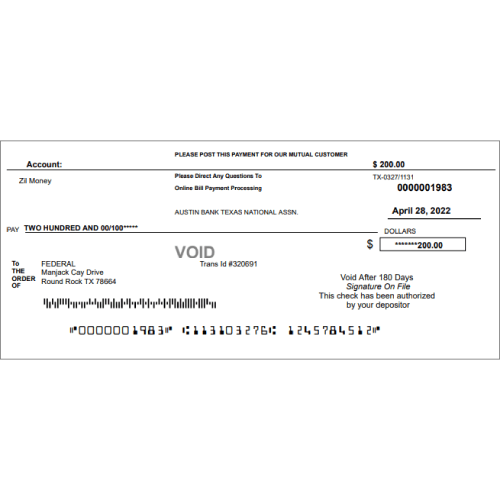

| Bank Draft And Pay Order |

|

| Difference Between Bank Draft And Money Order Difference Between |

|

| Demand Draft Wikipedia |

Posting Komentar untuk "money order vs bank draft"